Vishal Mega Mart IPO seems to be a good opportunity. The company has a strong market presence and growth potential. But we should invest in a good society considering pricing and competition.

Vishal Mega Mart IPO is attracting the attention of many people. It has been discussed extensively until now. The subscription period for this IPO is until 12 December 2024. Many people want to invest in it. This shows that people have confidence in the company. It seems that it will perform well after entering the stock market. Despite such high demand, Vishal Mega Mart’s entry into the stock market seems successful.

Points About the Vishal Mega Mart IPO

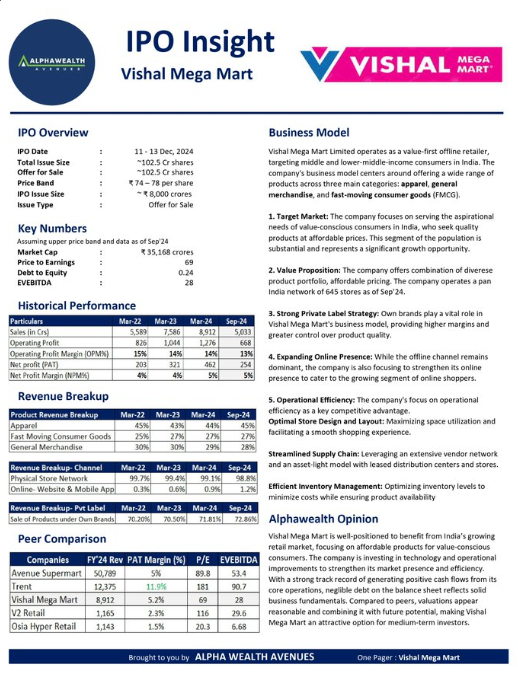

Vishal Mega Mart IPO opened on 11 December 2024. Investor interest is increasing after opening. This is 51% subscribed by the end of Day 1. This is much more than the earlier 34%. The most interest is from retail and non-institutional investors (NIIs). Here retail subscription has reached 41%. NII has subscribed 60 percent more than its quota.

The IPO will close on 13 December 2024. The price of shares is between ₹74 to ₹78. Retail investors will have to bid a minimum of 190 shares. This is an investment of approximately ₹ 14,820. This price seems a bit competitive. Because the company’s growth is good and has a strong position in the market.

Vishal Mega Mart IPO: Grey Market Premium (GMP)

The most interesting part of Vishal Mega Mart IPO is its Grey market performance. Now shares are trading at a premium of ₹22. This means there can be a profit of 28-30% on listing. Gray Market Premium (GMP) often reflects the mood of investors. It seems positive for Vishal Mega Mart IPO. This means that demand is quite strong and good growth is possible even after listing.

Why Investors Are Showing Interest in Vishal Mega Mart IPO

Retail Sector Ki Growth

Vishal Mega Mart is quite popular in the India. This is a fast-growing retail sector. It is mainly for middle and lower-middle-class people. It focuses more on Tier-2 and Tier-3 cities. We can see a growth of 32% by 2023-2028. This thing creates a solid future for Vishal Mega Mart.

Financial Performance

Vishal Mega Mart earned revenue of ₹8,900 crore in FY24. This happened because of its network of 645 stores. Stores are in 414 cities and 30 states/union territories. The company’s inventory management and debt-free nature make it a safe and profitable option for investors.

Brokerage Reviews

Big brokerage firms have supported Vishal Mega Mart IPO.

- Choice Broking says IPO is right for long-term returns. Because the company’s revenue is continuously increasing.

- AUM Capital said the rising incomes of Indian households and the company’s edge over unorganized retailers are a big factor.

- Master Capital Services highlighted Vishal Mega Mart’s strong offline retail market position and ability to target middle-class customers.

Vishal Mega Mart IPO: Offer-for-Sale (OFS) Details

Vishal Mega Mart IPO is a complete Offer-for-Sale (OFS). This means that the money will be raised. The money will not go to the company. The money will be earned by those who are selling their shares. Due to this, the company will not get any extra funds for growth. Investors will get a chance to earn money by selling their shares.

Important Dates to Remember

- Anchor Investor Bidding: 10 December 2024

- IPO Closing Date: 13 December 2024

- Allotment Finalization: 16 December 2024

- Listing Date: 18 December 2024 (BSE and NSE)

Risks to Consider

Further, refine the risks of Vishal Mega Mart IPO. Add some points that will strengthen your analysis.

- Operational Challenges: Disruptions in the supply chain or rising input costs can affect profitability.

- Debt Levels: If the company has high debt then its financial flexibility may come under pressure.

- Regulatory Environment: What impact may changes in government policies or regulations have on retail operations? It is important to consider this also.

Do you need to add other risks like technology adoption or changing consumer preferences?

Vishal Mega Mart Limited IPO

— Tanmay 🇮🇳 (@Tanmay_31_) December 11, 2024

Final Verdict

Applying For Reasonable Listing Gains And Long-term

Highlights of the Issue :

Date : 11-13 December

Price Band : 74-78

Size : 8,000

(Full OFS)

M.cap : 35,168 Cr

Objects Of The Issue :

To Carry Out The Offer For Sale For Promoters… pic.twitter.com/ZVJovTSL7R

Vishal Mega Mart IPO: Conclusion

The Vishal Mega Mart IPO offers investors a chance to be part of a rapidly growing retail store in India. It has a strong market presence, strong financial position, and positive gray market performance. IPO is an attractive proposition for both retail and institutional investors. However potential buyers should carefully evaluate pricing and competitive dynamics before making a decision.

As soon as the subscription period ends. All eyes will be on the allotment results and listing performance of the IPO. If gray market trends are any indication. Vishal Mega Mart is set to make a strong debut on the stock exchanges. It promises substantial returns for early investors.

Also Read: Unbeatable Black Friday Deals You Can’t Miss in 2024!