This has increased investor sentiment in the housing finance sector, and key players have benefited from increased valuations and the ability to do well in the market.

Bajaj Housing Finance raised money in a pretty very successful IPO. It attracted many investors. This has boosted confidence in the housing finance sector. Other companies in the sector have also benefited from this success. Tata Capital, a big player in housing finance, has gained as well. Its good financial results and smart business plan have increased its value.

The success of Bajaj Housing Finance’s IPO has set a high standard. It has encouraged companies like Tata Capital to grow and compete better. Tata Capital has also benefited from this success. It is growing well and its value has gone up.

Market Performance and Investor Sentiment

The market has gone positive about the IPO of Bajaj Housing Finance along with its very first trade. The IPO did not do too badly, the stock price soared after beginning trading. That made quite a few feel good that the housing finance sector also was on the right track again. Other companies like Tata Capital also benefitted from these sentiments.

Experts believe that the good business, low bad loans, and strong technology of Bajaj Housing Finance have been the reasons for its good performance. Many investors are now hopeful about housing finance companies due to this. The value of Tata Capital has also increased, along with its competitors. The reason for such an uptrend in the value of investors’ stocks is that these companies have enormous growth potential.

Bajaj Housing Finance Share Price spurts on December 5: What drives the stock rally?

On December 5, Bajaj Housing Finance ended 5.65% higher at ₹168. This increase was due to several reasons:

1. Strong Growth: The company is growing well, with more assets under its management. This makes investors feel confident about the company.

2. Low Bad Loans: Bajaj Housing Finance has a low number of bad loans. This means its finances are healthy, which makes investors feel safe.

3. Technology: The company uses strong technology to work better and stay ahead of others. It is also more attractive to investors.

Thus, the increase in Bajaj Housing Finance’s stock can be attributed to good growth, good financial health, and a high usage of technology, attracting more investors.

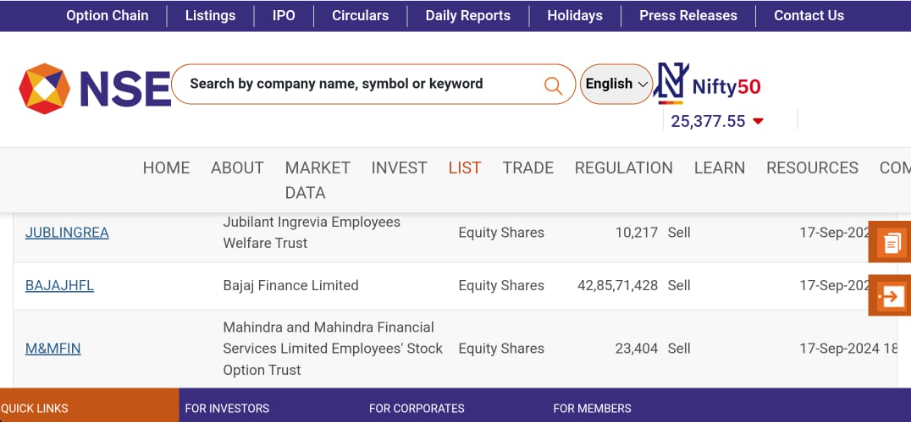

Bajaj Housing Finance #BAJAJHFL

— Stockeens (@Stockeens) December 5, 2024

– Forming an Inverted H&S / Reversal pattern.

– But 50 EMA will act as resistance.

– Let us see if it breaks out and closes above the resistance zone & 50 ema.#BreakoutStocks #StockMarketIndia pic.twitter.com/uumRXgjuIS

Tata Capital Valuation

Tata Capital’s value has gone up a lot. This is largely due to Bajaj Housing Finance’s healthy performance as well as a growth spurt in the housing finance market.

Analysts are following Tata Capital since it is quite well placed in the competitive space of housing finance. Value has accrued because of growth, which began in earnest with Bajaj Housing Finance’s IPO.

Investors are becoming more confident in companies like Tata Capital.

This is so because Tata Capital is financially sound and the housing loan demand is rising. The company is in a strong position to take advantage of this growth.

Tata Capital FY24 Results

Tata Capital has shared strong financial results for FY24. The company showed good growth in important areas.

Tata Capital has a strong business model that includes consumer finance, corporate lending, and wealth management. This has helped its value increase. The company’s growth in assets and smart risk management strategies have made investors trust it more.

The results show that Tata Capital can adapt to changes in the market and take advantage of new opportunities, especially in housing finance and other financial services. Because of this, its value has gone up, making it a strong player in the finance market.

Tata Capital Net Worth, Valuation

Tata Capital has shown strong financial results in FY24, showing steady growth and a solid business. The company has done well by growing in different areas, especially in housing finance and investments. This shows that Tata Capital can compete well in the market and handle changes in the economy. The growth in revenue and profits shows it is in a strong position, which makes investors more confident and increases its value.

As confidence in the housing finance sector grows, Tata Capital’s net worth and value have also gone up. This increase is because of its good financial results, strong business strategies, and overall positive feeling in the market, especially after the successful IPO of Bajaj Housing Finance. The company is now in a stronger position among housing finance firms, with its value rising due to both its growth and the market’s optimism.

Key Financial Metrics

Tata Capital has strong financial numbers, which are helping its value grow. The company has shown good revenue growth in different areas, especially in housing finance and investments. Its profits have also increased, thanks to smart investments and efforts to reduce costs.

Tata Capital has kept its asset quality high, with low bad loans. This helps make the company more stable and attractive to investors. These good results are building more confidence in the company, making it stronger in the housing finance market. The company’s consistent performance is a key reason why its value is going up.

Bajaj Housing Finance Share Price Future Outlook

The future of Bajaj Housing Finance looks good. The company is expected to keep growing as the housing finance market expands. Experts believe the company will continue to do well as its assets maintain steady growth, and it has minimal bad loans with good strong technology.

Bajaj Housing Finance has a good business with smart investments, which is likely to take the price of its stock higher during the next few months. Along with the growth of the housing finance industry, more investors are sure to show interest in the company. But it will still depend on the overall economy as well as how well it keeps up with its competition.

Competitive Landscape

The success of Bajaj Housing Finance after its IPO is helping the entire housing finance sector, including Tata Capital. Investors are more interested, and the value of companies in this sector is going up. This has created strong competition, pushing companies to improve and grow.

Tata Capital, as a top company in this field, can benefit from this focus on the sector. Bajaj Housing Finance’s success has set a high standard, so companies are now working harder on keeping their assets strong, using better technology, and focusing on customers.

This competition will help the sector grow and give better returns to investors. Companies that offer good services, perform well financially, and plan smartly are likely to do better and grow faster in the housing finance market.

Also Read: SAP: Supercharge Business Data with RISE and AWS Glue